Debt Service Coverage Ratio (DSCR)

Definition

The Debt-Service Coverage Ratio (DSCR) is a financial ratio that measures a company’s ability to use its operating income to repay all its debt obligations, including both principal and interest payments. It provides a straightforward way to gauge a business’s financial stability and its capability to sustain and manage its debts effectively.

Key Takeaways

- DSCR is a vital metric for assessing a company’s ability to pay its debts with its operating income.

- A DSCR greater than 1 indicates a business has sufficient income to meet its debt obligations, while a ratio below 1 signals potential financial distress.

- For new and pre-revenue businesses, a realistic and conservative projection of DSCR is critical for securing financing and demonstrating fiscal responsibility.

- Businesses can improve their DSCR through strategies such as optimizing operating expenses, realistically increasing revenue projections, extending loan terms, or providing a larger down payment.

- Cyclical businesses must adopt specific strategies, like diversifying revenue streams and building cash reserves, to manage fluctuations in DSCR effectively.

- Regulatory considerations and lender-specific criteria, such as those set by the SBA, play a crucial role in determining the standards and expectations for a business’s DSCR in loan applications.

Introduction

DSCR is a crucial financial metric for businesses, especially for those seeking loans or managing existing debts. It offers a clear snapshot of a company’s financial health by comparing its available cash flow to its debt obligations. Understanding DSCR is essential for business owners, financial analysts, and lenders as it helps assess the risk involved in lending and borrowing. This article aims to demystify DSCR, making it accessible and actionable for entrepreneurs at various stages of their business journey.

Relevance to Different Audiences

For Business School Students

Business school students aiming to master the concept of DSCR should direct their focus toward courses that delve into financial accounting and reporting, as well as corporate finance. These subjects lay the groundwork for understanding the financial statements crucial for DSCR calculations and provide insight into effective financial operations management, including debt and liquidity management. A course in real estate finance, for those where it’s available, can offer a specialized perspective on DSCR, especially relevant in property investments and mortgage lending contexts. To further enhance their learning, students are recommended to explore “Financial Intelligence for Entrepreneurs: What You Really Need to Know About the Numbers” by Karen Berman, Joe Knight, and John Case. This book demystifies financial metrics, including DSCR, making them accessible and actionable for individuals without a deep financial background.

For Pre-Revenue Startups

Pre-revenue startups need to emphasize the creation of realistic and conservative financial projections grounded in comprehensive market research. These projections should not only forecast future revenues and expenses but also demonstrate the anticipated DSCR. Such forecasting shows potential investors and lenders that the startup has a clear understanding of its future debt management strategies, highlighting its preparedness to maintain liquidity and profitability. This approach is vital for securing initial financing by reassuring financiers of the startup’s fiscal responsibility and strategic planning capabilities.

For SMB Owners

Small and medium business (SMB) owners contemplating loans for purposes such as expansion or commercial property acquisition must undertake a dual financial analysis. Firstly, calculating the current DSCR is essential for assessing the business’s existing financial health and its capacity to service current debt, serving as a baseline for future financial planning. Secondly, developing a financial model that projects the DSCR post-loan acquisition is crucial. This model should realistically forecast how additional debt will impact the business’s finances over the ensuing years, taking into account potential revenue increases from the expansion or acquisition. Such forward-looking financial planning not only facilitates strategic decision-making regarding loan applications but also aids in negotiating favorable loan terms. By thoroughly understanding and planning for their future DSCR, SMB owners can ensure they undertake new debts in a manner that aligns with their long-term growth and financial stability goals.

Calculating DSCR: A Step-by-Step Guide

Understanding how to calculate the Debt-Service Coverage Ratio (DSCR) is essential for businesses aiming to secure financing or manage their debts efficiently. Here’s a breakdown of the process, including critical concepts like Net Operating Income (NOI) and Total Debt Service (TDS), and why specific expenses are considered in these calculations.

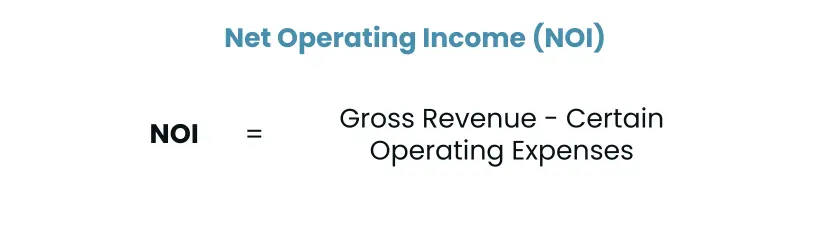

Step 1: Determine Net Operating Income (NOI)

NOI represents the core profitability of a business, derived from its operations before the consideration of financing costs and taxes. It’s calculated as:

Gross Revenue: This is the total income generated from the business’s core operations, excluding any income from investments or financing activities.

Certain Operating Expenses (COE): These are the costs associated with running the business’s day-to-day operations. It includes rent, payroll, utilities, and materials, but excludes taxes and interest payments. COE is included in the calculation because it reflects the ongoing costs necessary to maintain the business’s operational efficiency and revenue generation capabilities.

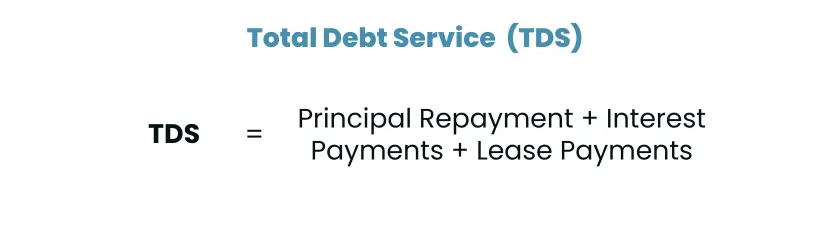

Step 2: Calculate Total Debt Service (TDS)

TDS encompasses all the obligations a business has to pay back its debts within a given period, typically one year. It includes:

Principal Repayments: The portion of the debt that reduces the outstanding loan balance.

Interest Payments: The cost incurred for borrowing the funds.

Lease Payments: Any lease obligations that must be met, considered a form of debt service.

Step 3: Divide NOI by TDS to Calculate DSCR

With both values determined, DSCR can be calculated as:

A DSCR greater than 1 indicates that the business has sufficient income to cover its debt obligations, whereas a DSCR less than 1 suggests potential financial stress.

The Role of Amortization

Amortization of loans is included in the TDS calculation as it impacts the principal repayment portion. Unlike depreciation, which is an accounting method to allocate the cost of tangible assets over their useful lives, amortization in this context refers to the gradual reduction of debt through periodic payments. Including amortization in TDS is crucial because it provides a realistic view of the business’s actual cash obligations towards debt repayment within the year, offering a more accurate measure of its ability to service its debts.

Why COE is Included

Including Certain Operating Expenses (COE) in the calculation of NOI ensures that the DSCR reflects the business’s profitability after accounting for the costs necessary to maintain operations. It highlights the company’s ability to generate enough operational income to cover debt obligations, providing a clear picture of its financial health and stability. Excluding COE would inflate the NOI, potentially misrepresenting the business’s true capacity to meet its debt service requirements.

Ways to Improve Your DSCR in Your Business Plan and Financial Projections

Improving the Debt-Service Coverage Ratio (DSCR) is crucial for businesses aiming to secure financing or optimize their debt management strategies. When drafting business plans and financial projections, certain measures can enhance DSCR, signaling to lenders a stronger capacity to service debt. However, it’s vital to balance optimism with realism, especially when projecting revenues and managing expenses.

Optimize Operating Expenses

Carefully review and optimize your operating expenses without compromising the essential components needed to run the business efficiently. Streamlining operations, negotiating better terms with suppliers, and adopting cost-effective strategies can improve operational efficiency and, consequently, your DSCR.

Increase Revenue Projections Realistically

Ensure all potential revenue streams are accounted for in your business plan. For instance, a restaurant should not only consider dine-in sales but also takeout, delivery, and retail sales of branded merchandise like t-shirts and mugs. Reevaluate your pricing strategy; slight adjustments in unit prices can significantly impact revenue without alienating customers or placing you at a disadvantage against competitors. This holistic approach to revenue generation can positively influence your DSCR.

Extend the Loan Term

While not always possible, negotiating a longer loan term can reduce the periodic debt service obligations, thereby improving the DSCR. It’s a strategy worth exploring with potential lenders, especially if it aligns with your business’s growth projections and cash flow patterns.

Provide a Larger Down Payment

Offering a larger down payment on a loan reduces the principal amount, leading to lower interest payments and, consequently, a lower total debt service requirement. This upfront investment can significantly improve your DSCR, making your loan application more attractive to lenders.

Incorporating these strategies into your business plan and financial projections requires a delicate balance between ambition and pragmatism. It’s crucial to present a business case that is both compelling and grounded in realistic expectations to maintain credibility with potential lenders and investors.

Fluctuations in DSCR in Cyclical Industries

Businesses in cyclical industries, such as construction, retail, and hospitality, often experience significant fluctuations in DSCR due to the seasonal or cyclical nature of their revenue streams. These fluctuations can present challenges in maintaining financial health and loan eligibility.

Understanding Cyclical Fluctuations

Recognizing and planning for the inherent variability in revenue and cash flow in cyclical industries is crucial. Businesses should conduct thorough market research and historical performance analysis to accurately forecast the highs and lows of their operational cycles.

Strategies to Manage Variance

To mitigate the impact of cyclical fluctuations on DSCR, businesses can adopt several strategies:

- Diversify Revenue Streams: Introducing additional services or products that have different seasonal demand patterns can stabilize revenue throughout the year.

- Build Cash Reserves: Setting aside profits during peak seasons can provide a buffer to cover debt obligations during slower periods.

- Flexible Financing Arrangements: In some cases, egotiating for loan terms that accommodate cyclical revenue patterns, such as seasonal repayment schedules or covenant holidays, can help maintain a healthy DSCR during off-peak times.

Effectively managing the fluctuations in DSCR in cyclical industries involves strategic planning and financial discipline. By understanding the cyclical nature of their industry and implementing measures to mitigate its impact, businesses can maintain a robust financial position and enhance their attractiveness to lenders.

Regulatory Considerations

Navigating the regulatory landscape is crucial for businesses seeking financing, as both government organizations and individual lenders impose standards that must be met. For instance, the Small Business Administration (SBA) sets forth specific guidelines that SBA lenders must adhere to. However, it’s important to recognize that each lender may have additional criteria that vary based on various factors such as the stage of the business, the industry, the Debt-Service Coverage Ratio (DSCR), the location of the business, the credit score of the borrower(s), and whether the business is part of an approved list of franchises, among others.

Businesses should consult resources like Businessplan.com’s SBA Lenders page, which allows filtering and finding lenders by critical factors such as loan type, loan use, and location. This tool can be invaluable in identifying the right lenders who are more likely to accommodate the unique aspects of your business.

The SBA provides clear standards regarding DSCR, distinguishing between smaller loans (up to and including $350,000) and larger loans (over $350,000), with respective DSCR minimums set at 1:1 and 1.15. These guidelines underscore the importance of not only meeting but exceeding these benchmarks to improve your chances of loan approval.

New Businesses Preparing for Loan Applications

For new businesses gearing up to apply for loans, presenting a well-constructed loan application is critical. Key components of a strong application include realistic, research-based financial projections that demonstrate a solid understanding of the market and the business’s potential. Highlighting the experience and expertise of the management team, especially their leadership qualities and industry-related experience, can significantly bolster the application.

A detailed “Sources & Uses of Funds” statement clarifies how the loan will be utilized and the returns it is expected to generate, providing lenders with a clear picture of the business’s financial strategy. Including a sensitivity analysis in the business plan shows foresight, demonstrating the business’s viability even if revenues fall short of conservative projections by 15%. For many lenders, ensuring that the DSCR remains above 1.3 under such conditions can be a key factor in the loan approval process.

Businesses must also be prepared to defend their financial projections, market research, and underlying assumptions. This defense should articulate the logic and data backing the projections, showcasing the business’s potential for success and its capacity to meet debt obligations comfortably.

By addressing these regulatory considerations and preparing thoroughly for loan applications, new businesses can significantly improve their chances of securing the financing they need to grow and thrive. This preparation involves understanding and navigating the standards set by organizations like the SBA, as well as presenting a compelling, well-researched business plan that demonstrates financial viability and a strong management team.

The Difference Between Interest Coverage Ratio and DSCR

DSCR and the Interest Coverage Ratio (ICR) are both critical metrics used to assess a company’s financial health, but they serve different purposes and provide unique insights into a company’s ability to meet its financial obligations.

The DSCR measures a company’s net operating income compared to its total debt service, which includes all required debt payments over a given period, not just interest but also principal, lease payments, and other fixed charges. This makes DSCR a broader measure of a company’s ability to sustain its debt obligations with its operating income. A higher DSCR indicates a company has enough income to cover its debt payments multiple times, which is a sign of financial stability and strength.

In contrast, the Interest Coverage Ratio focuses solely on a company’s ability to pay interest on its outstanding debt with its operating income. The ICR is calculated by dividing the earnings before interest and taxes (EBIT) by the interest expense during the same period. It is a narrower metric that indicates how many times a company can cover its interest expenses with its operating profit. This ratio is particularly useful for understanding the company’s short-term financial health and its ability to continue operations during tough economic times when profitability might be squeezed.

While both ratios are important for lenders and investors to understand a company’s financial position, the DSCR is often seen as a more comprehensive measure when assessing the risk of lending to a company, particularly for long-term loans.

How Banks and Underwriters Consider DSCR for New Businesses

Banks and underwriters give significant importance to DSCR when evaluating loan applications from new businesses. DSCR offers them a clear picture of the new business’s ability to generate sufficient cash flow to cover its debt payments. A new business with a higher DSCR is generally viewed as a lower credit risk.

When underwriters assess DSCR, they look beyond the numbers to understand the business model, the reliability of the revenue streams, and the company’s cost structure. They consider industry norms, the economic climate, and the business’s growth potential. For instance, a business in a volatile market might require a higher DSCR compared to one in a stable industry.

For new businesses, underwriters also evaluate the credibility and experience of the management team, the soundness of the business plan, and the thoroughness of the financial projections. They prefer conservative projections that demonstrate the new business can maintain a good DSCR even if the actual results are not as optimistic as forecasted.

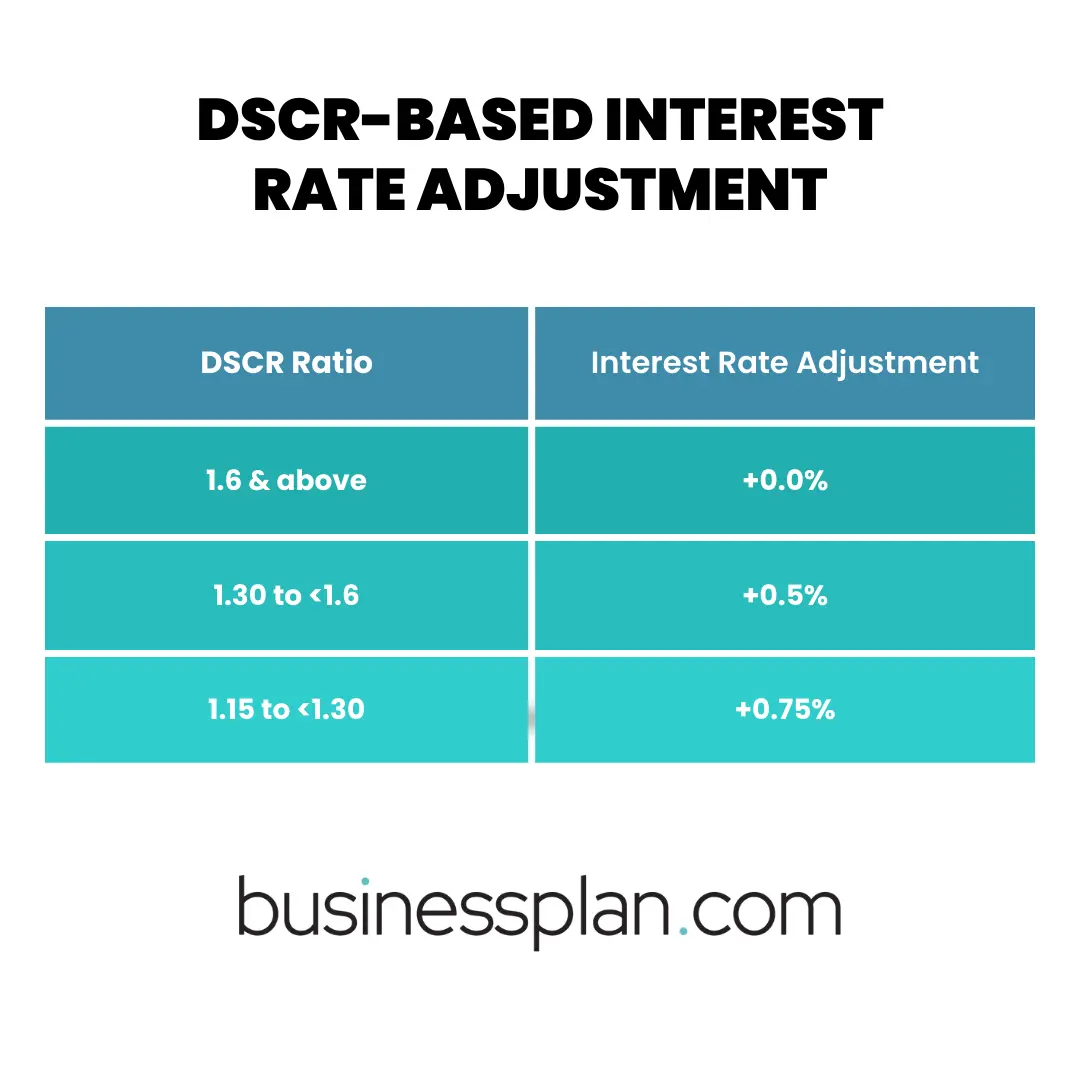

As seen in the example image, financial institutions often use DSCR to adjust the interest rates of the loans they offer. For example, a higher DSCR could result in a lower interest rate, as it implies less risk for the lender. This table indicates that a DSCR of 1.6 or above might not result in any interest rate adjustment, whereas a DSCR between 1.15 to less than 1.30 could see an increase in the interest rate, reflecting the increased risk the lender is taking on.

Frequently Asked Questions

- Can DSCR be too high, and if so, what does that signify for a business?

While a high DSCR is generally positive, an extremely high ratio may suggest that the company is not leveraging its capital efficiently and could potentially invest more aggressively to fuel growth.

- How does the amortization schedule of a loan affect the DSCR?

The structure of a loan’s amortization can impact the DSCR, particularly in the initial years. Loans with a balloon payment may show a higher DSCR initially, while those with consistent payments may have a more uniform ratio over time.

- In what ways can seasonal businesses stabilize their DSCR?

Seasonal businesses may stabilize their DSCR by diversifying their revenue streams, adjusting their operating models to account for off-peak seasons, and structuring their debt to reflect their fluctuating income.

- Are there industry-specific DSCR benchmarks that companies should aim for?

Yes, DSCR benchmarks can vary significantly between industries due to differing business models and financial risk profiles. Companies should research industry standards to understand how their DSCR compares.

- How do lenders view a DSCR that is exactly 1?

A DSCR of 1 indicates that a company’s operating income is just enough to cover its debt payments, which might be seen as a break-even situation with no room for error or unexpected decreases in income.

- Does refinancing existing debt affect a company’s DSCR?

Refinancing can affect DSCR, especially if it leads to lower interest rates or changes in the repayment schedule, potentially improving the ratio if it results in lower annual debt service requirements.

Related Terms

- Net Operating Income (NOI): Income from a company’s primary business operations, excluding expenses such as interest and taxes.

- Total Debt Service (TDS): The total amount of cash required to cover repayments of interest and principal on a debt for a specific period.

- Certain Operating Expenses (COE): Regular expenses essential for the day-to-day operations of a business, not including interest payments and taxes.

- Principal Repayments: Payments made to reduce the outstanding balance of a loan.

- Interest Payments: Payments made to a lender for the cost of the borrowed funds.

- Lease Payments: Regular payments made to lease assets which are considered in debt calculations.

- Amortization: The process of spreading out a loan into a series of fixed payments over time.

Also see: Net Operating Income (NOI), Lease, Amortization