9 Signs the Beauty Sector’s Investment Glow-Up Is on the Horizon

The investment landscape for the beauty sector experienced a notable chill in 2023, as venture capital and private equity investments dipped to their lowest in nearly a decade. This trend mirrored a broader decline across all industries, which saw venture funding ebb significantly. Despite these downturns, emerging patterns and expert analyses provide compelling evidence that the beauty industry may be on the cusp of an investment revival.

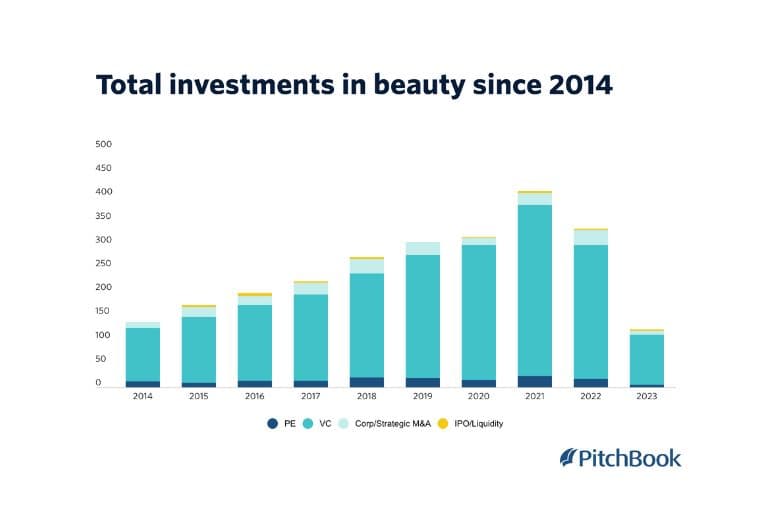

PitchBook, detailing total investments in the beauty sector since 2014, illustrates a stark descent from the dizzying heights of 2021 to a trough below 2014 levels.

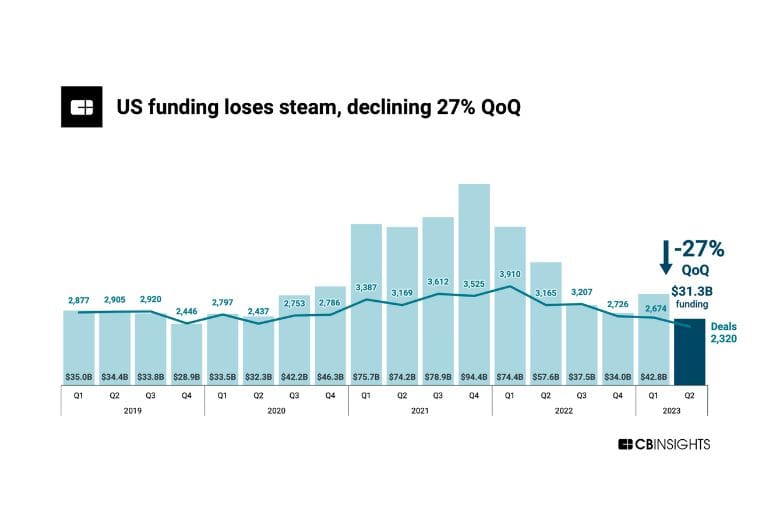

However, this plunge is not isolated; CB Insights’ data on venture capital funding across all industries reflects a similar trend, with investments contracting by a staggering 27% quarter-over-quarter in Q2 2023—a clear signal of a widespread investment retreat.

Yet, amidst this challenging climate, there are nine key indicators that suggest the beauty sector’s investment glow-up is on the horizon:

- Resilient Consumer Spending: The beauty sector has always had a tenacious grip on consumer wallets, even in the face of economic adversity. The ‘Lipstick Effect’—a theory suggesting that consumers turn to small luxury goods such as beauty products during economic downturns—seems to be holding firm. As Maria Monteros reports, “People are indeed splurging on beauty products,” suggesting that the industry’s offerings are seen as an affordable indulgence during tough times. This consumer behavior could provide a buffer against the harsher impacts of a slowing economy.

- Strategic Corporate Ventures: In the corporate sphere, strategic ventures are signaling a continued belief in the sector’s potential. A prime example is Shiseido’s establishment of LIFT Ventures, a corporate venture capital fund with a Western focus, which aims to invigorate its portfolio with fresh, innovative companies from outside its traditional Asian markets. Ron Gee, President & CEO of Shiseido Americas, underscores this strategic shift, stating, “Our mission statement is beauty innovations for a better world”—indicating the company’s commitment to fostering new ideas and technologies in beauty and wellness.

- Targeted Venture Capital Interest: Despite the broader decline in investment, certain segments within the beauty industry continue to attract venture capital, thanks to a confluence of innovation and market demand. Firms with a clear focus on community, sustainability, and technological integration are particularly appealing.

- Investable Brand Qualities: “3 Venture Capitalists on the Beauty Trends They’re Investing in This Year,” an article by Erika Veurink for Byrdie, highlights the qualities that make a beauty brand investable. Venture capitalists share insights into what they look for, including strong community engagement, innovative use of technology, and sustainability practices.

- Startup Funding Success: The resilience of the beauty sector is further evidenced by the continuous funding of innovative startups, even in a tough fundraising environment. For instance, the makeup artist-founded brand Makeup By Mario closed a $40 million minority growth investment, and the e-commerce platform Thirteen Lune secured an $8 million seed plus investment round. These instances underscore the sector’s vibrancy and the confidence investors have in its growth potential, suggesting a readiness among venture capitalists to back beauty companies that demonstrate strong market potential and innovation.

- Diversification Strategies: Diversification is a strategic approach that venture capitalists and corporate investors alike are adopting to mitigate risks and capture new opportunities. Shiseido’s venture capital fund, LIFT Ventures, exemplifies this strategy by expanding its investment focus to include Western markets. This geographic diversification reflects a broader industry trend where investors are looking beyond their traditional markets to tap into emerging beauty innovations globally, thereby spreading risk and increasing the potential for high returns.

- Luxury Market Resilience: Luxury Market Resilience: The premium and luxury segments of the beauty market continue to demonstrate resilience, even in the face of economic challenges. Luxury conglomerate LVMH reported another record year in 2023. The group’s Perfumes & Cosmetics business posted organic revenue growth of 11%, driven by the excellent momentum in fragrances and makeup across all regions. Profit from recurring operations for this segment increased by 8%. The ongoing global success of Dior’s Sauvage, once again the world’s best-selling fragrance in 2023, underscores the enduring appeal of premium beauty products. This segment’s stability not only attracts investors looking for safe harbors but also underscores the beauty sector’s diverse market dynamics, where different segments can thrive under varying economic conditions.

- Sustainability and Wellness Focus: The shift towards sustainability and wellness is reshaping the beauty industry’s investment landscape, as investors increasingly back brands that champion clean beauty and holistic well-being. WTHN, a modern wellness brand rooted in Traditional Chinese Medicine, recently raised $5 million in Series A financing led by L Catterton, with participation from Halogen Ventures and a syndicate of cross-industry angel investors. The funding comes amidst a year of significant omnichannel expansion for the brand, which offers both in-person treatments and at-home products. With the global wellness and health market poised to surpass $1.3 trillion by 2025, WTHN’s success in securing funding underscores investors’ growing interest in brands that offer science-backed, holistic solutions to consumer wellness needs. This shift towards sustainability and wellness is driven by consumer demand for transparent, ethical, and health-conscious products and services, making this segment an attractive area for future investments in the beauty and wellness space.

- Cultural Alignment and Founder Relationships: Shiseido’s investment strategy illustrates the significance of cultural alignment and founder relationships in the decision-making process. The company’s emphasis on the omotenashi spirit—a deep-rooted approach to hospitality and customer service in Japan—extends to its investment philosophy. Building strong, meaningful relationships with potential investment partners is paramount. This approach underlines the importance of not just financial metrics but also the shared values and visions between investors and companies. As Ron Gee suggests, investment decisions are as much about the people and culture behind the brands as they are about the innovations they bring to the table.

A synthesis of these nine indicators—from resilient consumer spending and strategic corporate ventures to the embrace of clean beauty and the premium market’s stability—paints a composite picture of confidence in the beauty sector’s investment future. These factors, coupled with the sector’s inherent capacity for innovation and adaptation, provide a solid foundation for anticipating a rebound in venture capital and private equity investments.

The potential rebound is not just about recovering to previous levels but could herald a new phase of strategic and thoughtful investment, potentially leading to market consolidation and the emergence of new leaders in the beauty space. Despite the significant dip in investments in 2023, the beauty industry stands on the cusp of a promising revival.

The enduring allure of beauty products as affordable luxuries, strategic expansions by major corporations, the rise of innovative startups, and a shift towards sustainability and wellness are collectively signaling a brighter investment horizon. As the industry navigates this challenging but dynamic landscape, the adaptability and resilience of beauty brands, coupled with a strategic approach from investors, are set to redefine the future of beauty investments. The beauty sector’s investment glow-up, while momentarily dimmed, is poised to illuminate once more, powered by a confluence of consumer loyalty, innovation, and strategic foresight.